Japan’s No. 1 SME M&A Advisory Firm

From Japan to Thailand—we are bringing the best M&A experience closer to you

Japan No. 1 SME M&A Advisory Firm

Extensive Global Network

Complete Support for Every Sector

About Us

Nihon M&A Center (Thailand)

For more than 30 years, Nihon M&A Center in Japan has established itself as the country’s largest independent and trusted M&A advisory firm, supporting more than 10,000 businesses in Japan and internationally to grow and succeed.

In 2021, Nihon M&A Center expanded its presence to Thailand, launching its local office to support cross-border M&A between Thailand and Japan. Drawing on our extensive experience from Japan and other international markets, our team in Thailand is dedicated to helping businesses explore strategic M&A opportunities. We aim to contribute to the long-term growth and success of Thai companies through tailored advisory services and strong cross-border collaboration.

Our Services

Connecting Your Business to Global Opportunities

Why Us?

A strong network in Japan, driving your business growth

At Nihon M&A Center Thailand, we truly understand the unique needs of Thai SMEs and the local culture. Drawing on our success in Japan, we are bringing together the best of both worlds—Japan and Thailand—offering a wealth of knowledge to help you navigate cross-border M&A. Our approach is fair and transparent, ensuring every deal is in the best interest of both sides.

Our Mission

is to contribute to the continuity and prosperity of companies through M&A.

Our Vision

We focus on building strong, lasting relationships, guiding you through the process with care, and helping your business grow beyond borders.

Guiding You Through Every Step of the M&A Journey

News & Events

Latest Update

Frequently Asked Questions

Please feel free to consult us about any concerns you may have.

We have compiled frequently asked questions and consultations regarding M&A and business succession.

I would like to know an approximate figure on how much my company is worth.

Please use our simplified share price simulation service.

Based on our extensive track record of M&A transactions, Nihon M&A Center Group provides a “Share Price Calculation Simulation Service” that is based on the actual conditions of M&A.

The simulation is fully supervised by the “Corporate Valuation Research Institute” of the Nihon M&A Center Group and provides an easy-to-understand share price estimate with simple operations. Please take advantage of this free trial.

I would like to know the cost structure for M&A advisory fee.

Although consultations are free of charge, once mandated from a party, both the transferring (sell-side) and acquiring (buy-side) companies pay an initial fee plus a success fee at the agreed timing with us.

- About the free consultation:

The free consultation is an opportunity for us to discuss about basics and cases of M&A, as well as the current market, along with your company strategy or issues to explore the pros/cons of pursuing an M&A. This consultation is done, before signing a contract, to inform you of the solutions that M&A can provide, and to share with you an image of the costs and sale price, so that you are prepared to proceed with M&A after dispelling any concerns.

Whether you are selling or buying a company or business, we will not charge you any fees until you sign a contract to formally mandate us to act as your advisor.

- About the initial fee:

Both sellers and buyers are required to pay an initial fee at the agreed milestone between Nihon M&A Center. Nihon M&A Center believes that this initial fee is the key to a successful M&A transaction for the following reasons :

Reason (1) : You can find a partner with a high level of seriousness.

Companies that sign an advisory agreement with us and pay an initial fee are companies that have a clear intention of divesting or acquiring the company or business. Therefore, by receiving the initial fee we try to minimize the cases where we introduce a company that would withdraw their intention during the process.

Reason (2) : Accurate matching and transparent process control can be achieved through proper advance preparation.

In order to proceed with the search for a partner in an M&A transaction, preliminary preparations such as valuation and preparation of documents (including but not limited to Information Memorandum) are necessary.

The initial fee includes a corporate valuation fee to neutrally calculate the shares of the transferring company, the cost of preparing a corporate profile that contains quantitative and qualitative information about the company based on research and analysis. We ask our clients to prepare an initial fee in order to make these preliminary preparations and to proceed with M&A safely and securely.

M&A is all about finding the ideal partner. Matching ideas should be considered by as many people as possible, and negotiations should proceed on an equal footing for both parties. Furthermore, we charge an initial fee so that our experts can be duly mandated as a business, and promise to spare no cost and time to conduct financial and business model analysis, industry research, company evaluation, etc., to enable matching with the best possible partner, without cost constraints.

- About success fees:

Success fee is received after the definitive agreement is signed and transaction completed. We receive a fee at the time the M&A is successfully completed. The calculation method is based on company valuation. If you want to know more, please contact us for a free consultation.

Will I be able to find the partner/buyer I desire?

Nihon M&A Center has built a system and structure to find a partner from its over 30 years of relation building and expertise.

We find the ideal partner for your M&A objectives through 1. our network of affiliated financial institutions and accounting firms nationwide, 2. our expertise cultivated through our many years of M&A support, and 3. our data-driven matching.

No. 1 M&A Advisory Track Record

For more than 30 years, Nihon M&A Center has helped many companies though successful M&A transactions.

With a cumulative total of more than 10,000 transactions, we boast an overwhelming number of M&A transactions completed in the M&A industry. Because of our extensive track record, we have a wealth of methods for successful M&A based on trends and analysis data based on our previous cases.

Unparalleled M&A information network

In 1991, the Nihon M&A Center was established as a joint venture by certified public accountants and tax accountants nationwide, and since then has partnered with over 1,000 firms. We have also expanded our partnerships with regional and major financial institutions throughout Japan, as well as with M&A boutiques in various countries. With these networks, we are able to offer our clients a wide range of options.

Can SMEs do M&A?

M&A is an option regardless of the size of the company.

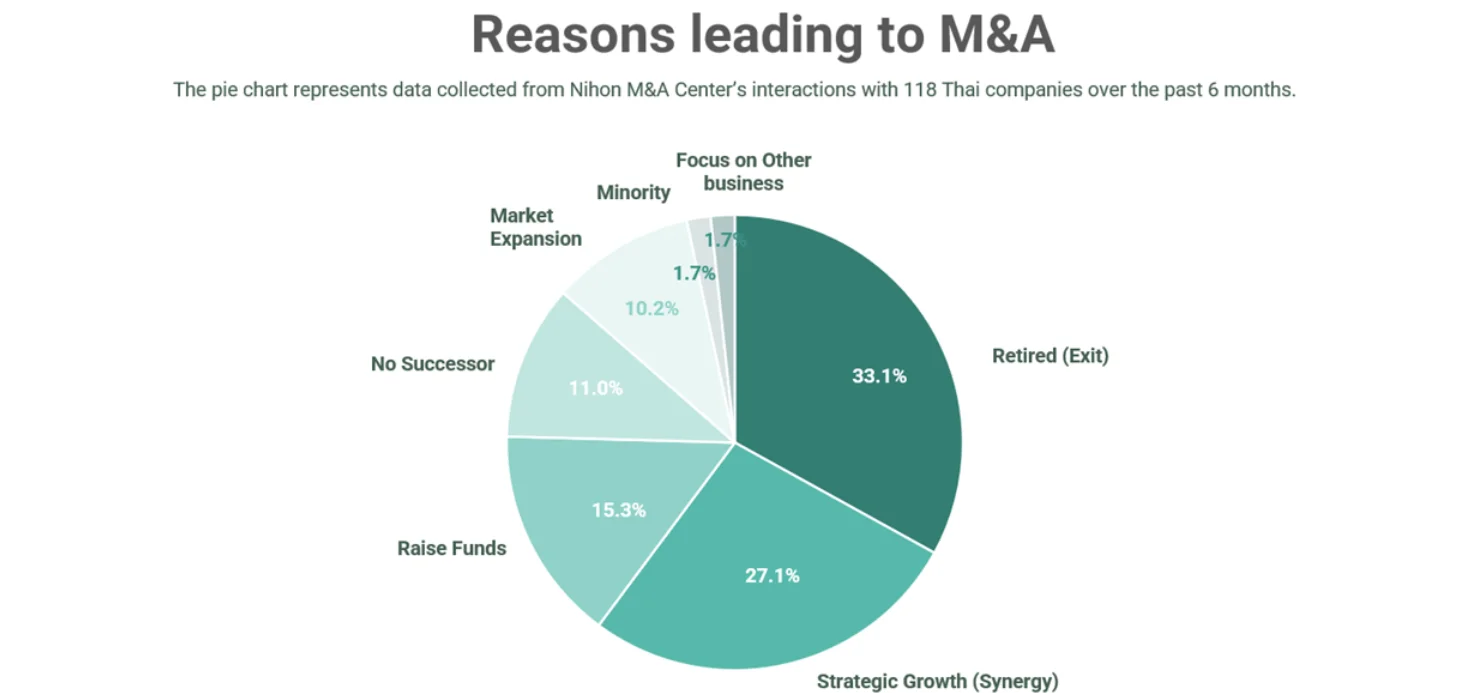

The number of M&As by SMEs had been on the rise, mainly due to “lack of successors” and “response to the shrinking domestic market”. However, in recent years, an increasing number of companies considered divestment for strategic alliance, for “growth strategy” or “industry restructuring”, where younger owners decided to take advantage of the resources of the buyer for faster growth or market shares.

In fact, this trend can be read from the fact that approximately 90% of our seller-side clients were small and midsize companies with sales revenue of less than 1 billion THB (based on our contract data for 2024).

(Of course, the M&A decision will be based on a thorough review of the company’s industry, financial position, and future growth potential, but) The buyer company’s concern with the seller-side company is whether or not it can retain its base of customers.

If the buyer company’s annual sales are 1 billion THB, if it can buy a company with annual sales of 400 million THB, group sales will increase by 40% to 1.4 billion THB. In this day and age, a 40% increase in annual sales is a rare occurrence, hence the buyer would be interested in the company as a valuable M&A target.

Nihon M&A Center Group provides M&A support focused on ownership changes of small and midsize companies. Because of the unique issues that arise in SME M&A, the support of a knowledgeable specialist is essential. We offer a free consultation service for questions about M&A and we hope you will take advantage of this service.

Can I still consult with you even if I don't have a firm M&A intention?

Many of the clients who come to us for consultation do not make the decision to pursue M&A from the beginning.

In most cases, they talk about management concerns as well as their potential successors such as relatives and employees, and inheritance.

The consultant will provide advice and suggestions, including examples of clients who have had similar problems in the past and whether M&A is the right option to solve them. For issues that can be resolved through M&A, we will provide the best examples and the latest M&A trends.

In addition, if you bring your financial statements to the consultation, we will provide a simple diagnosis that will give you a rough estimate of the sale price. Please be assured that this is an individual consultation that is strictly confidential and free of charge.

We can also accommodate requests for date, time, location, and meeting method (face-to-face/web meeting, etc.). Please take advantage of this free consultation opportunity.

Will information be leaked to employees, business partners, or financial institutions?

Please be assured that we will handle your request with the utmost confidentiality.

M&A is said to “begin and end with confidentiality,” which means that the utmost care is required in the handling of information. Please feel free to contact us for further information, as we will arrange the initial consultation in an environment where confidentiality is protected.

Even as we proceed with the full-fledged process of finding a partner for an M&A transaction, we take the utmost care to maintain confidentiality in various aspects, including the location of consultations, delivery of documents, and methods of communication, in order to prevent information from being divulged to related parties.

If I want to sell only a part of my shares/one business unit, can you handle that?

We can propose an appropriate transaction scheme depending on the details of your consultation. There are various M&A schemes available depending on the purpose, such as minority interest transfer, capital increase, business transfer, demerger, etc. Our team of experts in M&A will propose an appropriate scheme, so please consult with us first.

How long will it take to divest the shares/businesses?

We ask that you keep an eye on it for at least one year.

In M&A of small and medium-sized companies, many owners wish to not only inherit the company itself, but also the philosophy and culture that the company has built.

In this case, we select an ideal partner that shares our values as a candidate company, and after discussions between the two companies, we take the time to confirm the management philosophy and other steps. In this case, we ask our clients to allow at least 6-12 months for this process.

In addition, there are many cases where there are special circumstances that make M&A urgent, such as the company’s cash flow or the owner’s health condition. In such cases, we identify the priorities of the conditions and respond with an emphasis on speed.

The time it takes to find candidate companies will also vary depending on the industry, region, and desired conditions. If a company is the target of a strong acquisition need, it will be easier to find a potential buyer and there is a greater likelihood that the desired terms will be met, so the M&A timeframe will be relatively shortened.

We cannot give you a specific time frame for M&A, but we recommend that you allow plenty of time for preparation.